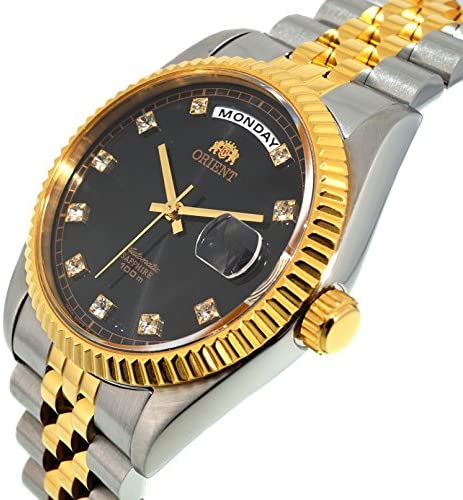

International watch - الساعة العالمية - ساعه ORIENT اتوماتيك موديل قديم 1970 جديده سعر البيع 350 دينار | فيسبوك

ساعة اورينت اليابانية الكلاسيكية اوتوماتيك بتاريخين الاصدار القديم ستانلس ستيل بلون ذهبي مينا اسود للرجال - SAB06001B8 - Noor For World Watches