Beauty🫧 on X: "شوفوا برضوا كلام ستايل نجلاء عن الكريم لما شمته فعلًا كلمه يجنن قليله فيه🤍🤍 https://t.co/o6irJ2YsLy" / X

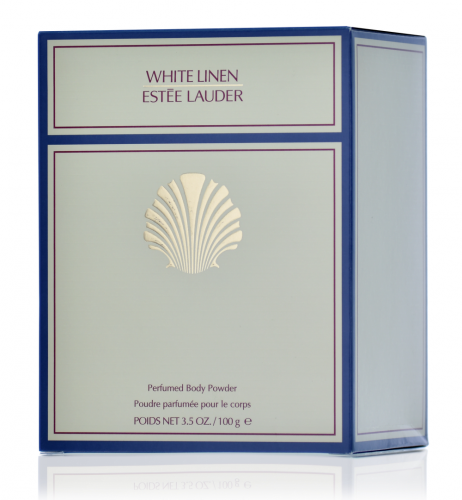

ضحى on X: "بودرة جسم من ESTÉE LAUDER Beautiful White Linen أنصح أي بنت تقتنيهم.. خاصة العروس لازم تصير عندها.✨🤍 من الروائح الناعمة الزهرية الكلاسيكية ثباتهم جميل. جربت عدة أنواع من بودرة

بودرة بيوتيفول الأصلية من استي لودر -ليليان افضل متجر عطورات اصلية - ليليان متجر عطور أصلية تسوق افضل العطور العالمية وعطور النيش السعودية

متوفر للبيع الفوري عطر وايت لينن وبودرة وايت لينن من استي لودر ورد بلغاري، ياسمين، بنفسج، سوسن، نجيل الهند،عنبر سعر العطر حجم 60 ml… | Instagram

بودرة معطرة للجسم وايت لينن للنساء 3.5 اونصة، من ايستي لودر: اشتري اون لاين بأفضل الاسعار في السعودية - سوق.كوم الان اصبحت امازون السعودية

Vivenzakwt - أخيرا وصلت بودرة وايت لينن من ايستي لودر الأولى عالمياً 😍😍 ريحتها ثابته وملمسها عجيب عالبشره😍 . متوفر فقط في فرع الجيت مول و كويت ماجيك حيااااكم 🌹 او تقدرون