♦️♥️عطرشهرة النسائي♥️♦️ عطر رصاصي شهرة من أكثر العطور النسائية مبيعاً فهو منتشر في الدول الخليجية بكثرة حيث يفضلن النساء رائحته المميزة… | Instagram

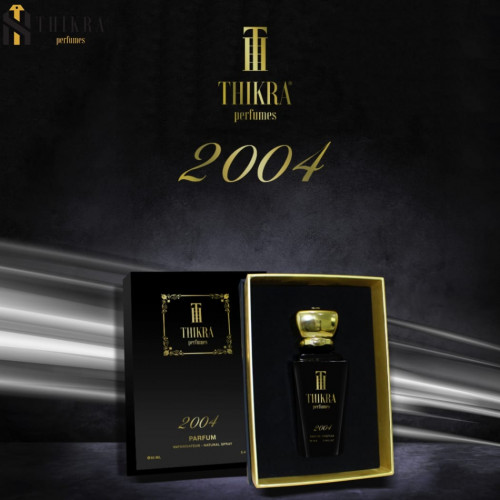

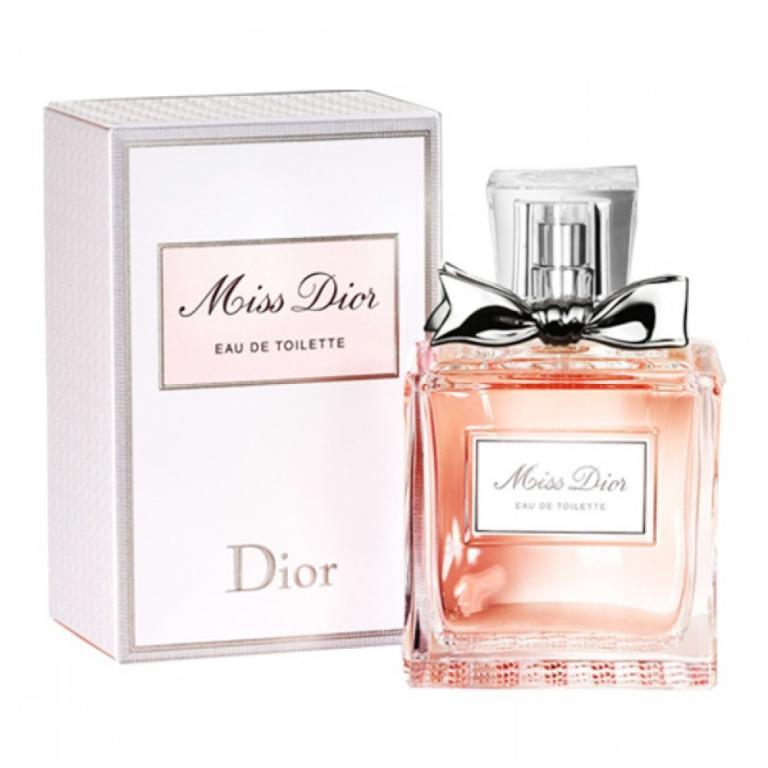

قائمة أفضل العطور النسائية والأكثر شهرة في العالم 2023 - ارومادن - متجر إلكتروني في السعودية للعطور المستوحاة

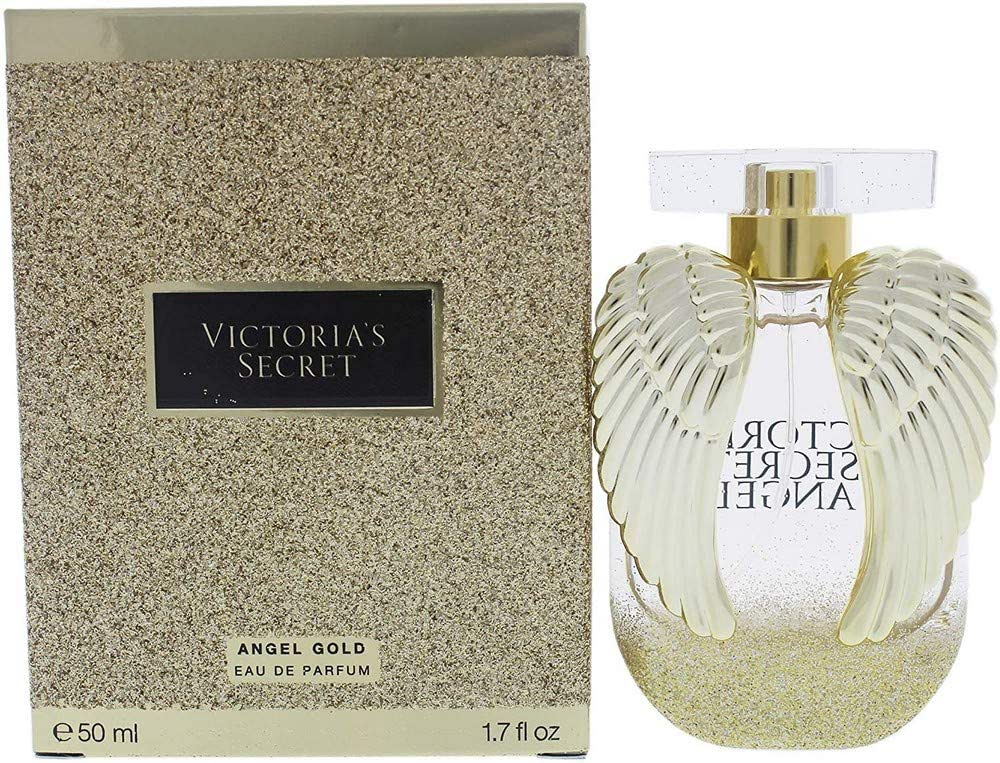

كوزمتك زينب - عطر غرام اليل من أكثر العطور النسائية مبيعًا على مستوى العالم. عطر يفوح بروائح الأزهار، فهو مزيج غني من بتلات أزهار الفريزيا، الياسمين، الورد والأوركيد، التي تختلط مع النكهات