قلادة مجوهرات عين حورس المصرية المطلية بالمينا بدلاية عين حورس را وينغز من النحاس الصلب على شكل طوق فرعوني، دلاية قلادة بدلاية من مصر القديمة لحماية الفراعنة والازياء التنكرية : Amazon.ae: ملابس

/product/23/999244/1.jpg?0808)

تسوق عين مصر غامضة من حورس قلادة قلادة النساء/الرجال الذهب لون شرير العيون قلادة مصر جولة المجوهرات اونلاين | جوميا مصر

/product/80/103134/1.jpg?2665)

تسوق قلادة ذهبية بتصميم عين حورس للنساء - قلادة كريستالات علاجية - 80% من نحاس سيناء اونلاين | جوميا مصر

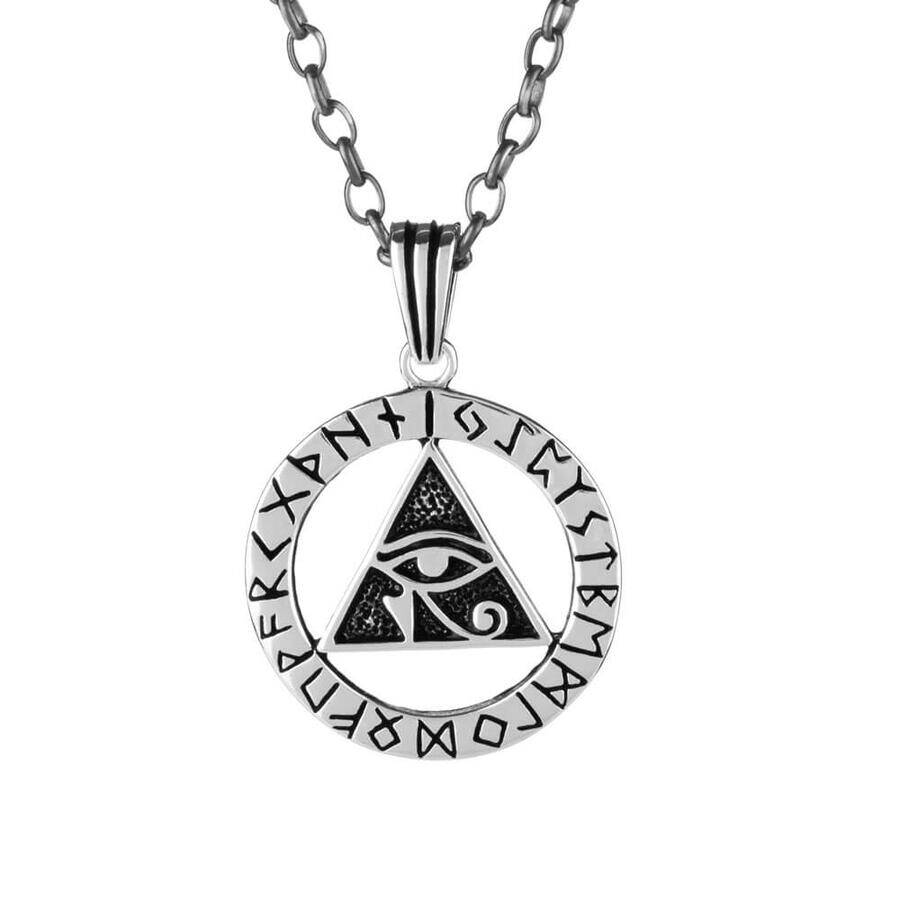

مصر عين حورس قلادة قلادة الفولاذ المقاوم للصدأ النساء/الرجال الذهب الفضة اللون سلسلة العين الشريرة مصر سحر مجوهرات الأزياء - AliExpress

بي دي تي جيه ام تي جي قلادة عين حورس من الفضة الاسترلينية مع قلادة عين حورس المصرية مع سلسلة من الستانلس ستيل 22 انش + 2 انش، هدية للرجال والاولاد، فضة

/product/56/159493/1.jpg?0365)