ساعة كاسيو 5554 جي شوك مقاومة للماء بعقارب / رقمية للرجال | GBA-800-2ADR ،اشتر الآن، أفضل الأسعار في السعودية الرياض، جدة، المدينة المنورة، الدمام، مكة

محل يشتري ساعات مستعملة بالرياض | كاسيو ساعة عملية كاجوال للرجال انالوج بعقارب بلاستيك مطاطي - MW-240-2B

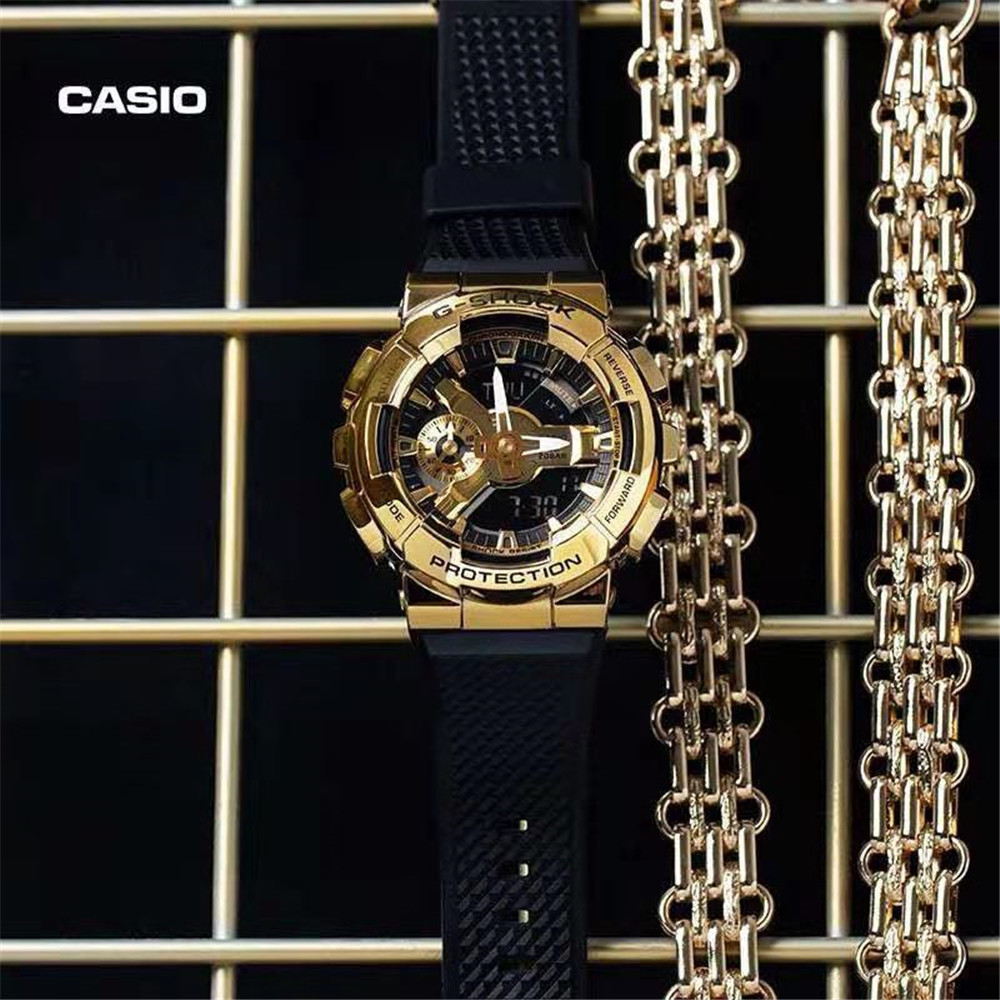

ساعات كارتير تقليد درجة اولى للبيع رولكس Casio Watch تقليد ريتشارد ميل أوميغا قوتشي Casio Watch موقع تقليد ماركات رخيصه بالجمله الصين الرياض Casio Watch جدة متجر السعودية دبي الكويت قطر

اشتري اونلاين بأفضل الاسعار بالسعودية - سوق الان امازون السعودية: ساعة كاسيو للرجال AE-1000W-2AV- رقمية، رياضية : ملابس وأحذية ومجوهرات

اشتري اونلاين بأفضل الاسعار بالسعودية - سوق الان امازون السعودية: ساعة كاسيو للرجال - رقمية بسوار من الراتنج - F-91W-1SDG : ملابس وأحذية ومجوهرات

احصلي الآن على آخر ساعة من ساعات كاسيو الرياضية.. بسعر 99 ريال سعودي فقط..! متانة التصميم الرياضي .. بنعومة التفاصيل الأنثوية … | Casio, Breitling watch, Breitling

مواصفات و سعر ساعة كاسيو جي شوك النسائية ، شاشة انالوج رقمية ، مينا بيضاء ، كربوني كور GMA-S2100-7A S2100 S2100WT 7A2JF في السعودية | قارن الأسعار