من أم حديجان إلى ربوع بلادي .. الترفيه والفكاهة والثقافة تمتزج بموائد إفطار رمضان زمان | صحيفة المواطن الالكترونية للأخبار السعودية والخليجية والدولية

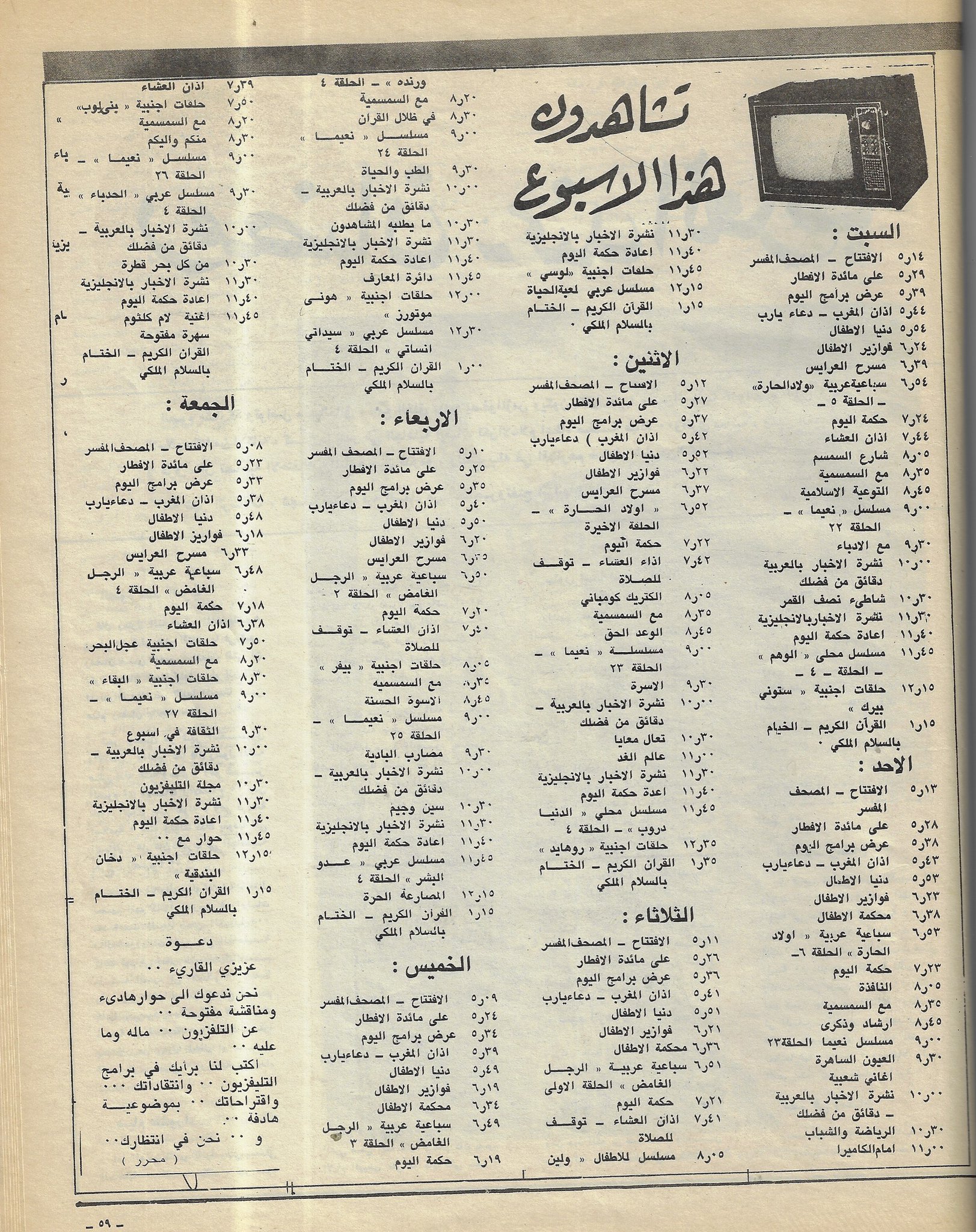

ذكريات Memories on X: "مميز ..... برامج التلفزيون السعودي لمدة أسبوع في منتصف شهر رمضان في العام 1395 هــ ....... ما الذي بقي من هذه البرامج يذاع في شهر رمضان حتى اليوم ؟

التلفزيون السعودي يعيد الزمن القديم بقناة خاصة لبث أرشيفه | صحيفة المواطن الالكترونية للأخبار السعودية والخليجية والدولية

وزارة الإعلام on X: "من ذاكرة #رمضان.. فوازير رمضان للصغار بثت في التلفزيون السعودي عام ١٤١٩ هـ https://t.co/mujHIwV2QH" / X