غسول حمض الساليسيليك | غسول للوجه من حمض الساليسيليك بنسبة 2% للبشرة الدهنية المعرضة للبثور (100 مل) | خالٍ من الكبريت، منظف للوجه مضاد لحب الشباب مع LHA والزنك للرجال والنساء

غسول الوجه العشبي بالفحم المنشط لإزالة السموم من جوفيز لبشرة ناعمة ومرنة - البشرة الدهنية والمعرضة للبثور - خالٍ من البارابين والكحول، 120 مل (عبوة من 3 قطع) : Amazon.ae: الجمال والعناية الشخصية

غسول الوجه الاحترافي تشاربون من هيربتوني كيو للتقشير وإزالة السموم للبشرة الدهنية والمعرضة للبثور (200 مل) : Amazon.ae: الجمال والعناية الشخصية

غسول جليكوليك اسيد | غسول الوجه CeraVe Acne Treatment | منظف حمض الساليسيليك مع الطين المنقي والنياسيناميد والسيراميد | التحكم في المسام ومزيل الرؤوس السوداء | 8 اونصة

سعر ومواصفات مقشر يومي للتخلص من الرؤوس السوداء فيزيبلي كلير من نيتروجينا – 150 مل من souq فى مصر - ياقوطة!

منتجات ولوازم تجميل المانية - garnier hautklar aktiv غسول ومقشر للرؤوس السوداء ومعالجة حب الشباب تقشير الوجه للبثور المستعصيةوالرؤوس السوداء مركب بجزيئات تقشير دقيقة لازالة الشوائب تحارب الرؤوس السوداء والبثور المستعصية وتساعد

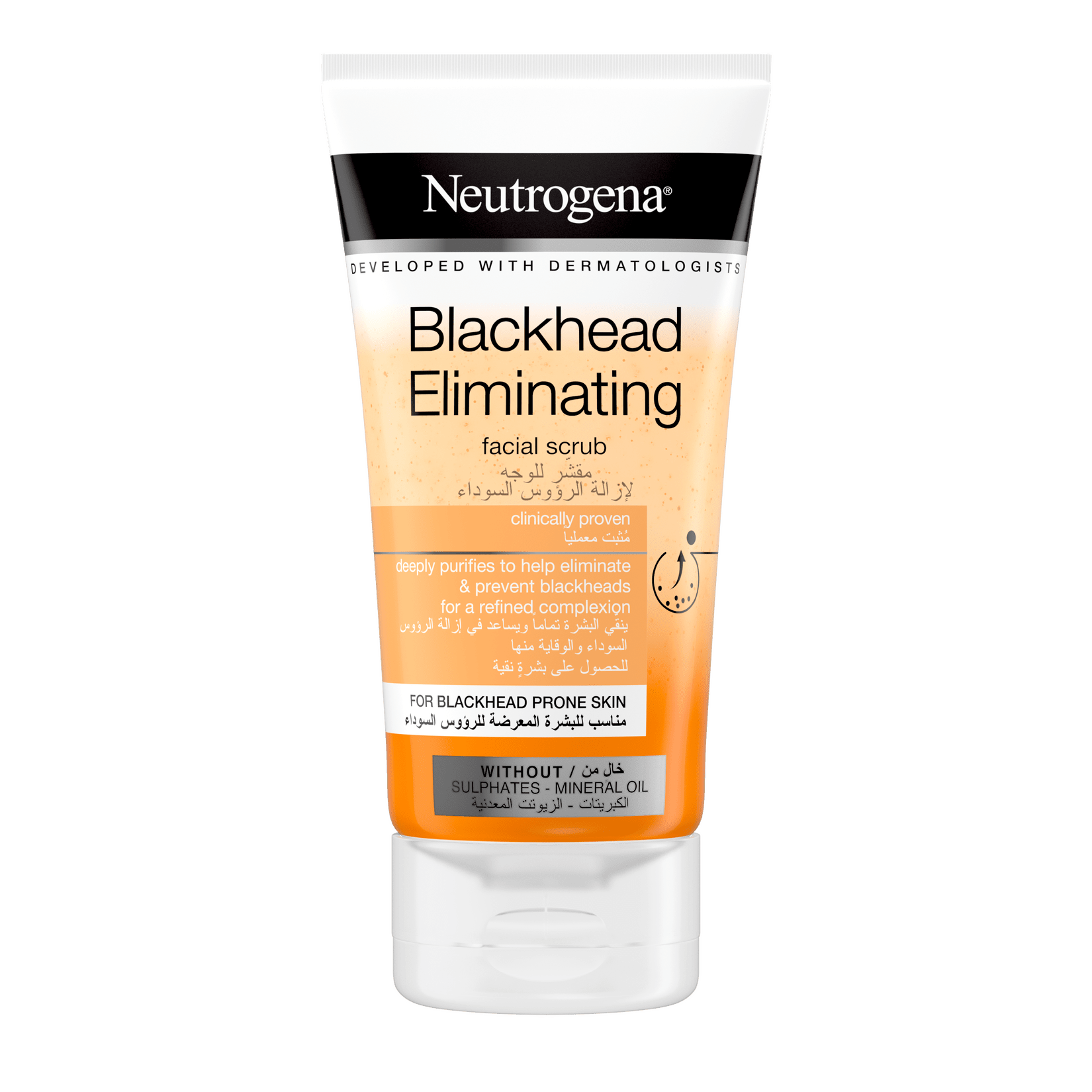

أشتري مقشر لإزالة الرؤوس السوداء مع حمض الساليسيليك المنقي من نيتروجينا 150 مل اون لاين | بووتس الإمارات العربية المتحدة الإمارات

/public/uploads/products/1607944308himalaya-face-washjpg)