أسعار مواد البناء والكهرباء الخرطوم السجانه - #اسعار_مواد_السباكه_و_الأدوات_الصحية مواد السباكه #الصنف #السعر 🔖توصيلات PPR :- 💧ماسوره ١" 400ج 💧ماسوره ٤/٣" 250ج 💧ماسوره ١/٢" 170ج 📌#ملحقات ppr ١" :- 💧كوع ١". 22ج 💧تي

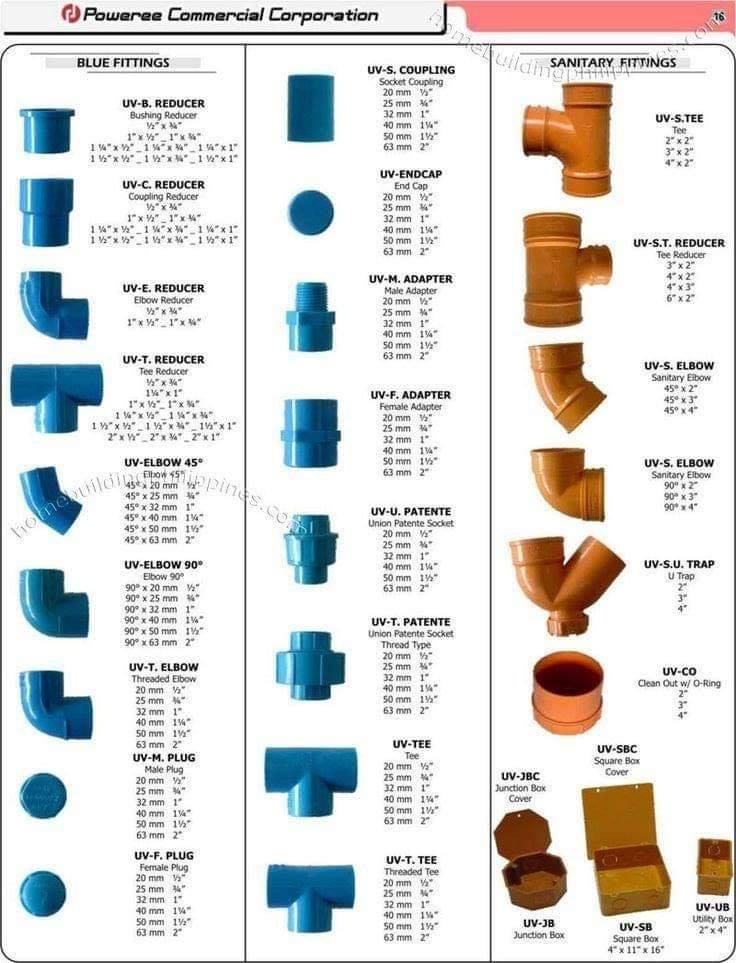

✓ أسماء قطع السباكة : منقول... - مكتب وادي ادس للاستشارات و الاعمال الهندسية - ليبيا - بني وليد | Facebook

Hdpe مواد السباكة تعلن أسماء Pipes PE المواد الري الزراعي HDPE أنبوب الغاز - الصين أنبوب أسود، خرطوم مياه، أنبوب ري، البولي إيثيلين عالي الكثافة، أنبوب، الصمام، من الفولاذ المقاوم للصدأ، موصل،

اشترِ وصلة السباكة البلاستيكية (PVC) ذات الضغط العالي و المصنوعة من مواد عالية الجودة تباع بالقطعة عبر الإنترنت بأفضل الأسعار في الإمارات العربية المتحدة

مواد السباكة طاعون المجترات الصغيرة المناسب المصنعين والموردين الصين - منتجات مخصصة بالجملة - كانغيو

صور لمشغل الموسيقى arabic, الكثير من معارض الصور الكثير من على Alibaba.com, صورة مشغل الموسيقى arabic

EGYREVIT | ايجي ريفيت on X: "مصطلحات واسماء قطع السباكة تغذية وصرف. #تصميم # السباكة #بيت_العمر #اليوم_العالمي_للمعلم https://t.co/ORuPXyqAsx" / X

EGYREVIT | ايجي ريفيت on X: "مصطلحات واسماء قطع السباكة تغذية وصرف. #تصميم # السباكة #بيت_العمر #اليوم_العالمي_للمعلم https://t.co/ORuPXyqAsx" / X