وصل حديثًا بدلات رجالي مكونة من 3 قطع بقصة ضيقة وصدرية ذروتها وزر واحد بدلات زفاف مناسبة للحفلات الراقصة سترة أفضل رجل jacketpa

أزرق ملكي بدلات رجالي Terno Masculino سليم صالح أبيض كوستيوم بدل زفاف رجالي أحمر ملكي بدلة رجالي حفلة العريس DJ مرحلة سهرة - AliExpress

3 قطع بدلات رجالي رمادية ضيقة مناسبة لحفلات الزفاف (سترة + بنطلون + صديرية) : Amazon.ae: ملابس وأحذية ومجوهرات

بدل رجالي 3 قطع بقصة ضيقة غير رسمية رفقاء العريس الجيش الأخضر الشمبانيا التلبيب الأعمال البدلات الرسمية لحفل الزفاف الرسمي size م צֶבַע As picture color9

بدلات رجالي باللون الأخضر الداكن أطقم ملابس ضيقة من jacketpantsvest أزياء أنيقة مصممة للحفلات زي أوم بدلة للزواج size XXL צֶבַע same as image2

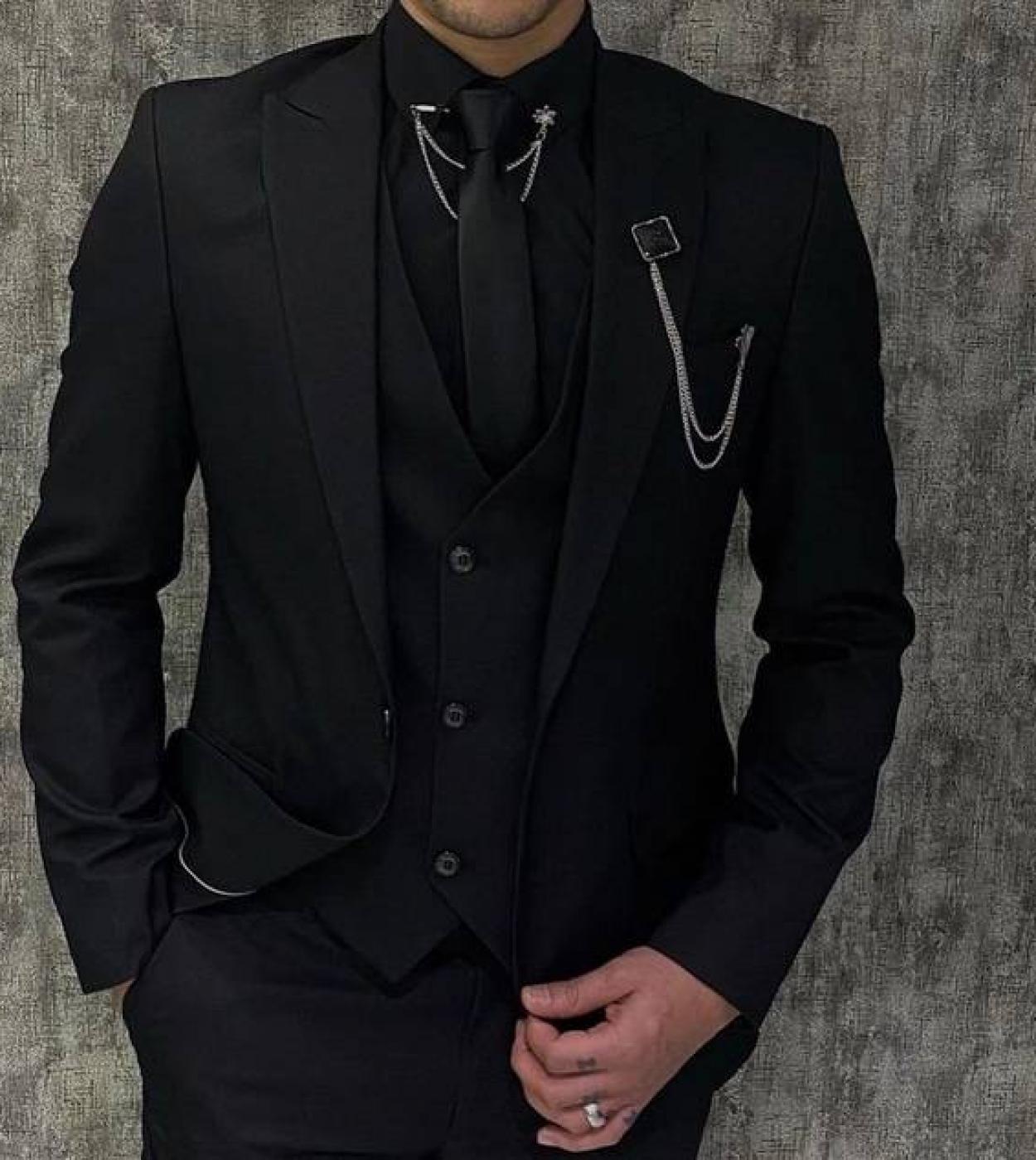

بدل رجالي سوداء فاخرة أنيقة ضيقة تناسب الذكور السترة الذروة التلبيب أحدث ثلاث قطع jacketpantsvest Terno Masculino

أطقم بدل رجالي 3 قطع كلاسيكية موضة 2023 بدل رجالي للعمل + سترة + بنطلون بدلات للخريف بدل رجالي لحفلات الزفاف - AliExpress