صناديق المؤشرات الشرعية on X: "ماهي أنواع الصناديق المختلفة؟ صناديق استثمارية Mutual Funds الصناديق الاستثمارية هي سلة من الأصول (أسهم صكوك…). الصناديق الاستثمارية في أصلها تدار عن طريق مدراء بشكل نشط ورسومها

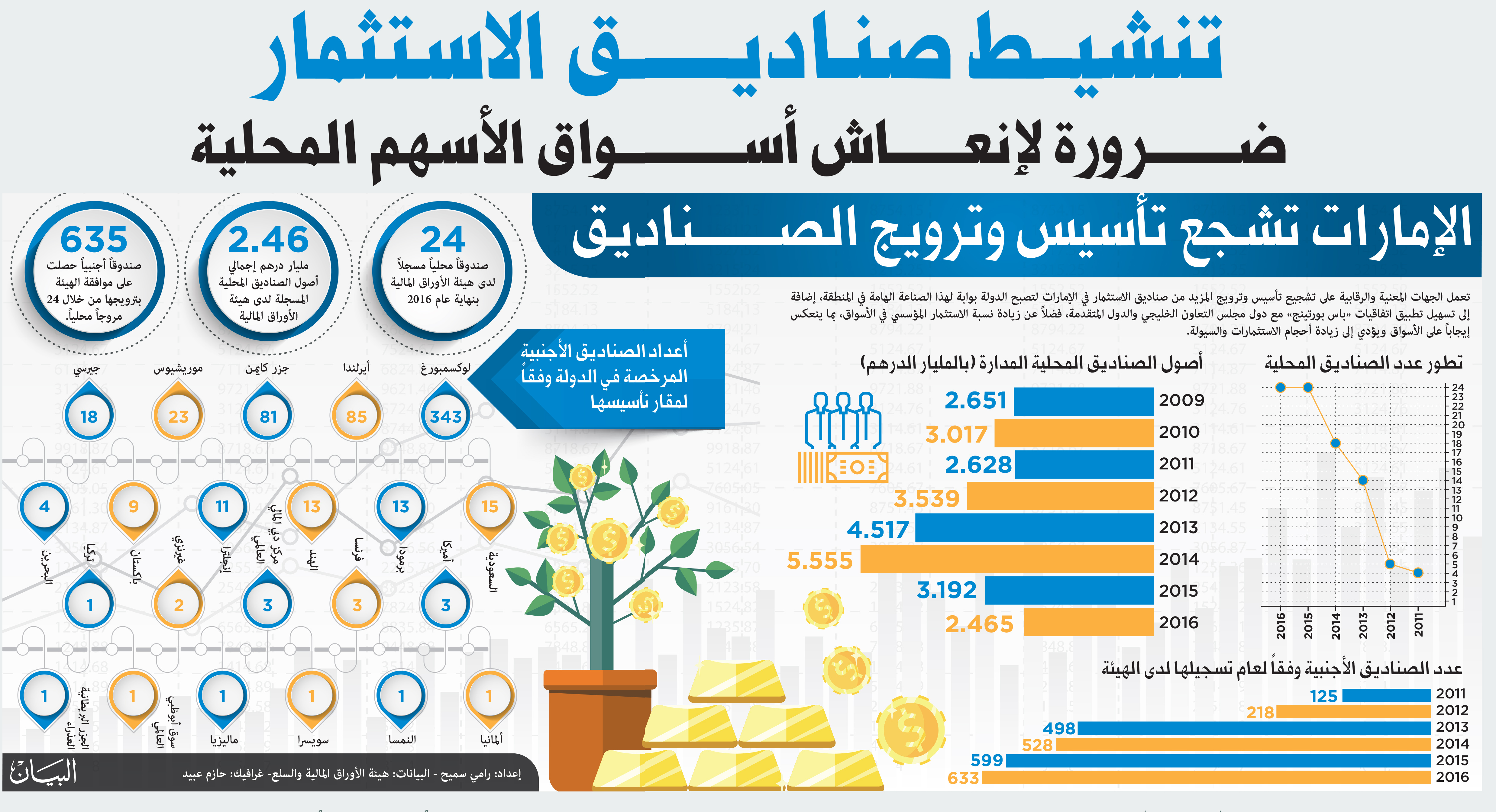

الاستثمار في صناديق الاستثمار المشتركة | ما هي صناديق الاستثمار المشتركة - بنك HSBC الإمارات العربية المتحدة

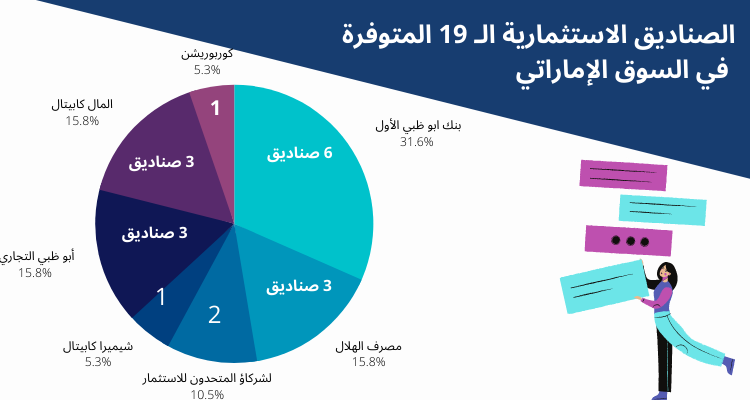

تعرف على الفرق بين صناديق الاستثمار العقارية المتداولة والصناديق الأخرى والأسهم.. وكيفية الاستثمار بها؟