مدارس الأنصار الأهلية - الصف الثالث الثانوي - الفصل الدراسي الأول - الفيزياء - التوالي والتوازي - YouTube

الموسيقى ! #سيد_الفقهاء_المرجع_الشيرازي_دام_ظلة #الشيرازي | By محبي سماحة السيد صادق الشيرازي | Absolute music what goes around. What if they change it a little so that the music does not violate. God

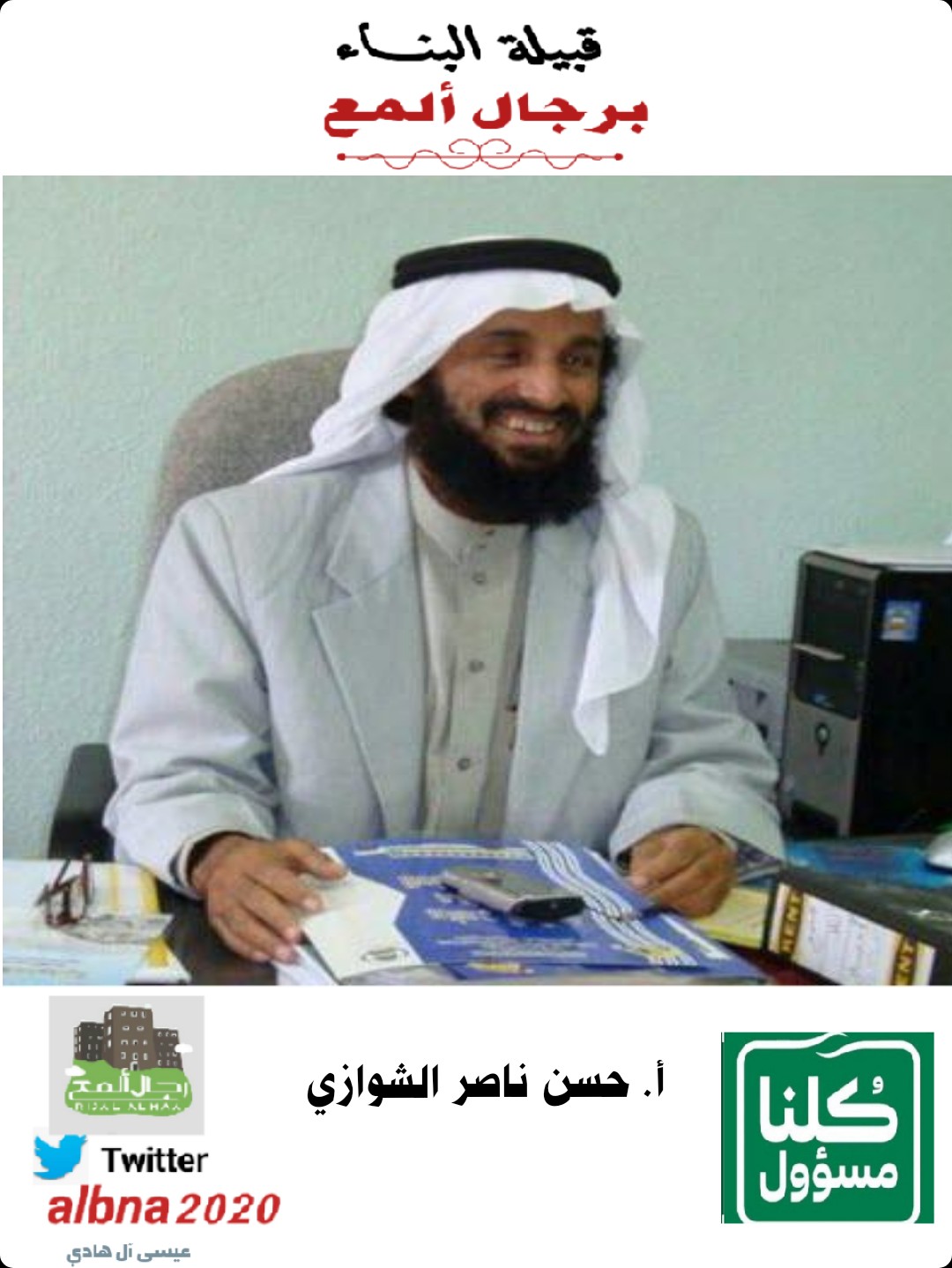

المنصة الإعلامية لقبيلة البناء برجال ألمع | عسير | on X: "#رحلوا وبقي ذِكرُهم. ♢الاسم / حسن ناصر علي الشوازي الميلاد/ ١٣٧٤هـ ♢من عشيرة المشوزة بقبيلة البناء. ♢عُرف بـسماحة الخلق وبشاشة الوجه

الشوازي المتجه, قصاصة فنية, بأسلوب الرسوم المتحركة السماوي والأزرق الفاتح, ملصق PNG والمتجهات للتحميل مجانا

.jpg)