فريزر افقي من فيشر، 145 لتر، 5.1 قدم مكعب، اسود: اشتري اون لاين بأفضل الاسعار في السعودية - سوق.كوم الان اصبحت امازون السعودية

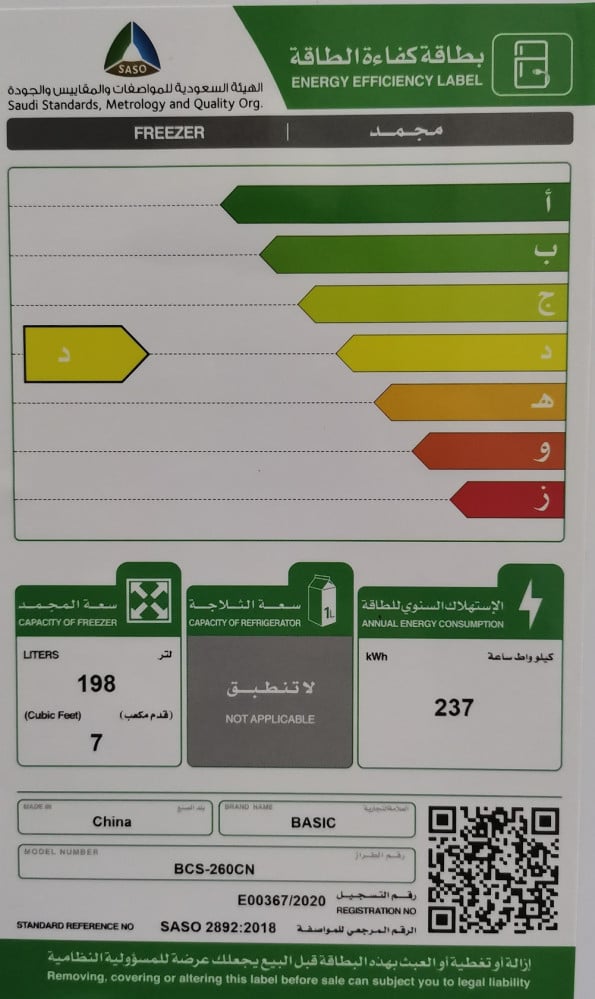

فريزر افقي بيسك 7 قدم 198 لتر، ابيض- متجر المستقبل - متجر المستقبل تسوق احدث الاجهزة المنزلية والمكيفات

فريزر افقي بيسك 7 قدم 198 لتر، ابيض- متجر المستقبل - متجر المستقبل تسوق احدث الاجهزة المنزلية والمكيفات

فريزر افقي بيسك 99 لتر 3.5 قدم موديل-BCS-130CN - متجر الغانم للأجهزة الكهربائية والتكييف في السعودية