ويدو سكين معجون نحاسي 2-1/2 انش، مكشطة طلاء بمقبض باكليت، اداة متعددة الاستخدامات من النحاس 5 في 1، سكين للجدران الجافة، اداة مكشطة للجص وكشط الجدران الجصية، طول 8 انش : Amazon.ae: أدوات وتحسين المنزل

قذيفة الطي سكين المحمولة ساعي سكين النحاس سكين رائعة سكين من خارج الصندوق سكين مفتاح سلسلة سكين صغير

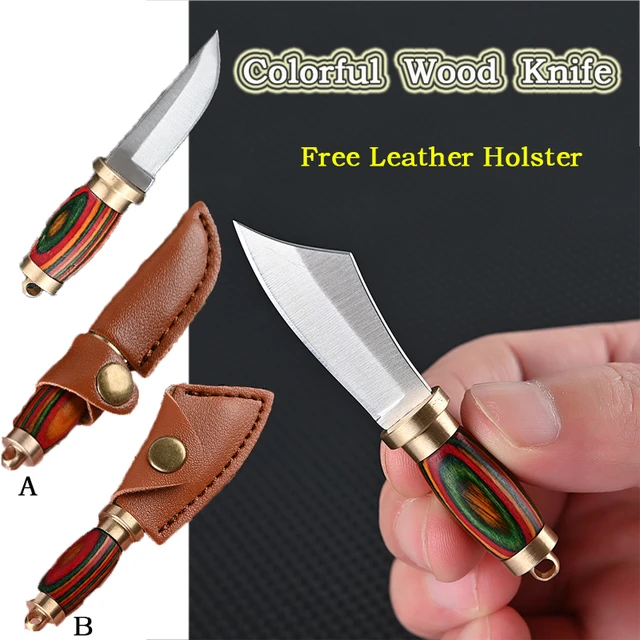

سكين نحاس صغير سكينة خشب محمولة غير ملاكمة مستقيمة مع حافظة جلدية CS الذهاب معلقة في الهواء الطلق التخييم EDC سكين - AliExpress

-min-2172-thumb-600x600.jpg)