كريم شعر باريس الاماراتي الأصلي 10دينار🔥❤ 🌺كريم شعر باريس معالج لتغذية الشعر ويعطي لمعان وكثافه وملطف عميق ومرطب ويصلح الشعر التالف والمتضرر كريم شعر باريس الاماراتي من افضل انواع كريمات الشعر للنساء

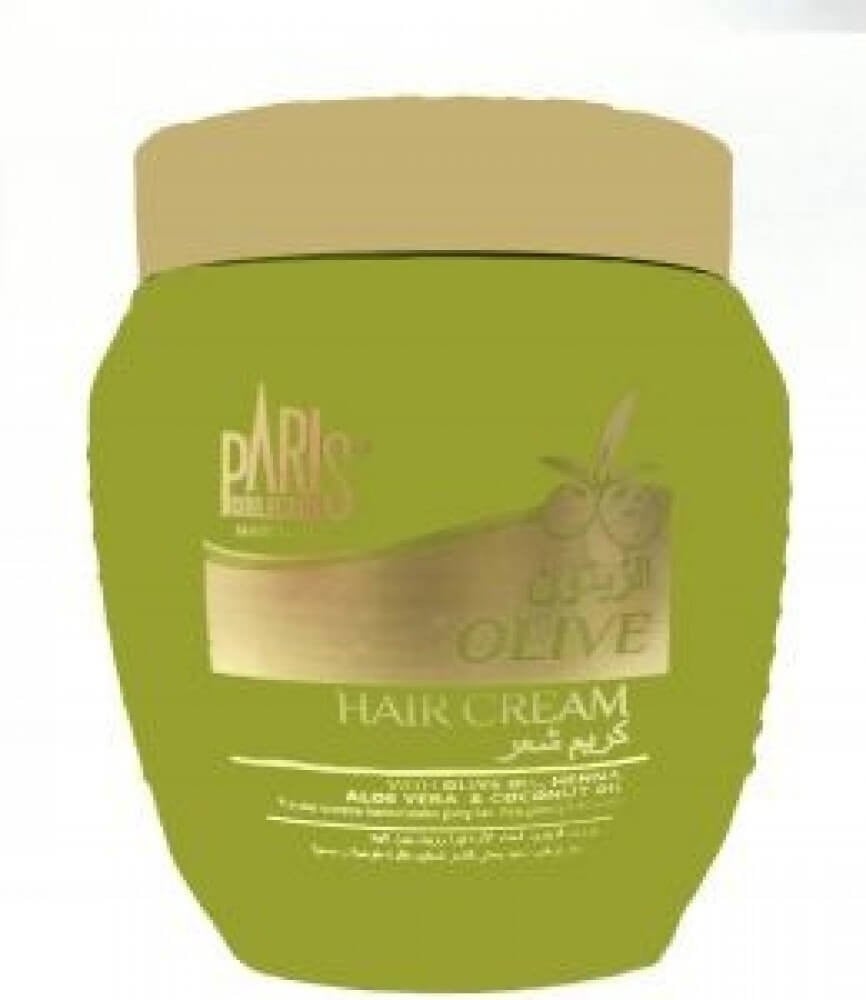

محل عطر الشرق للعطور ومواد الزينة والاكسسوارات - 💜كريم باريس الاصلي💜 متوفر 3 ألوان من افضل انواع كريمات الشعر للنساء والرجال الون الأبيض بالكرياتين الون الأخضر للقشرة الون الأحمر معالجة منتج طبيعي

باريس كوليكشن كريم شعر بزيت الارجان المغربي لترطيب الشعر بعمق | كريم لشعر لامع ولامع | خال من البارابين - 475 مل : Amazon.ae: الجمال والعناية الشخصية

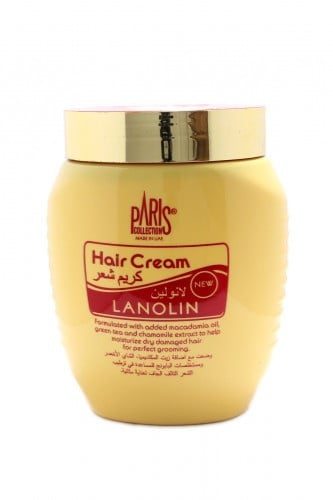

باريس كوليكشن كريم الشعر من لانولين للترطيب العميق للشعر الجاف والتالف والمجعد (للبنات/الاولاد) - 475 مل : Amazon.ae: الجمال والعناية الشخصية

باريس كولكشن كريم شعر - سموث كيراتين - 475 مل: اشتري اون لاين بأفضل الاسعار في السعودية - سوق.كوم الان اصبحت امازون السعودية

%E2%80%AC-550x385h.jpg)