◻️تركيب رفوف التخزين لأحد الزبائن 🌺 . ◻️ Fixing (grey) slotted angles shelves for customer 🌺 . للإستفسار / عن طريق الإتصال أو الوتسب :… | Instagram

صور لمشغل الموسيقى arabic, الكثير من معارض الصور الكثير من على Alibaba.com, صورة مشغل الموسيقى arabic

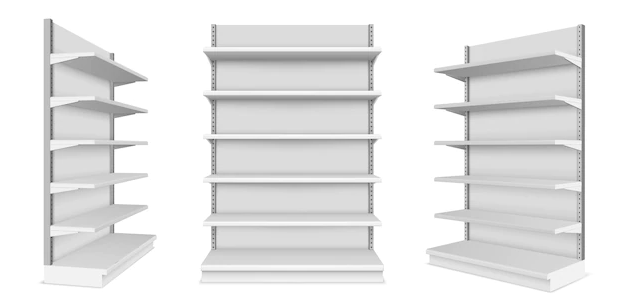

يؤدي الذعر بسبب فيروس كورونا إلى ظهور أرفف سوبر ماركت فارغة مليئة بمواد البقالة صورة الخلفية والصورة للتنزيل المجاني - Pngtree

صور لمشغل الموسيقى arabic, الكثير من معارض الصور الكثير من على Alibaba.com, صورة مشغل الموسيقى arabic

إيطاليا، فصل 52 عاملا من سوبرماركت في كروتوني عبر "واتساب": "انتزعوا منا العمل والكرامة" - الإيطالية نيوز