هبوط جنوني وغير مسبوق لاسعار جميع المنتجات والأجهزة من بنده السعودية .. لا تفوت آخر عروض الأسبوع | خدمات السعودية

pandasaudi on X: "الجودة والنعومة مع طقم مناشف مايكرو فايبر لمختلف الاستخدامات👌🏻 لاتفوتوها بأقوى العروض الحصرية لمدة 3 أيام فقط أو حتى نفاد الكمية.🤩 #بنده #هايبربنده #زادت_نقّصناها https://t.co/7dOOsLI4nQ" / X

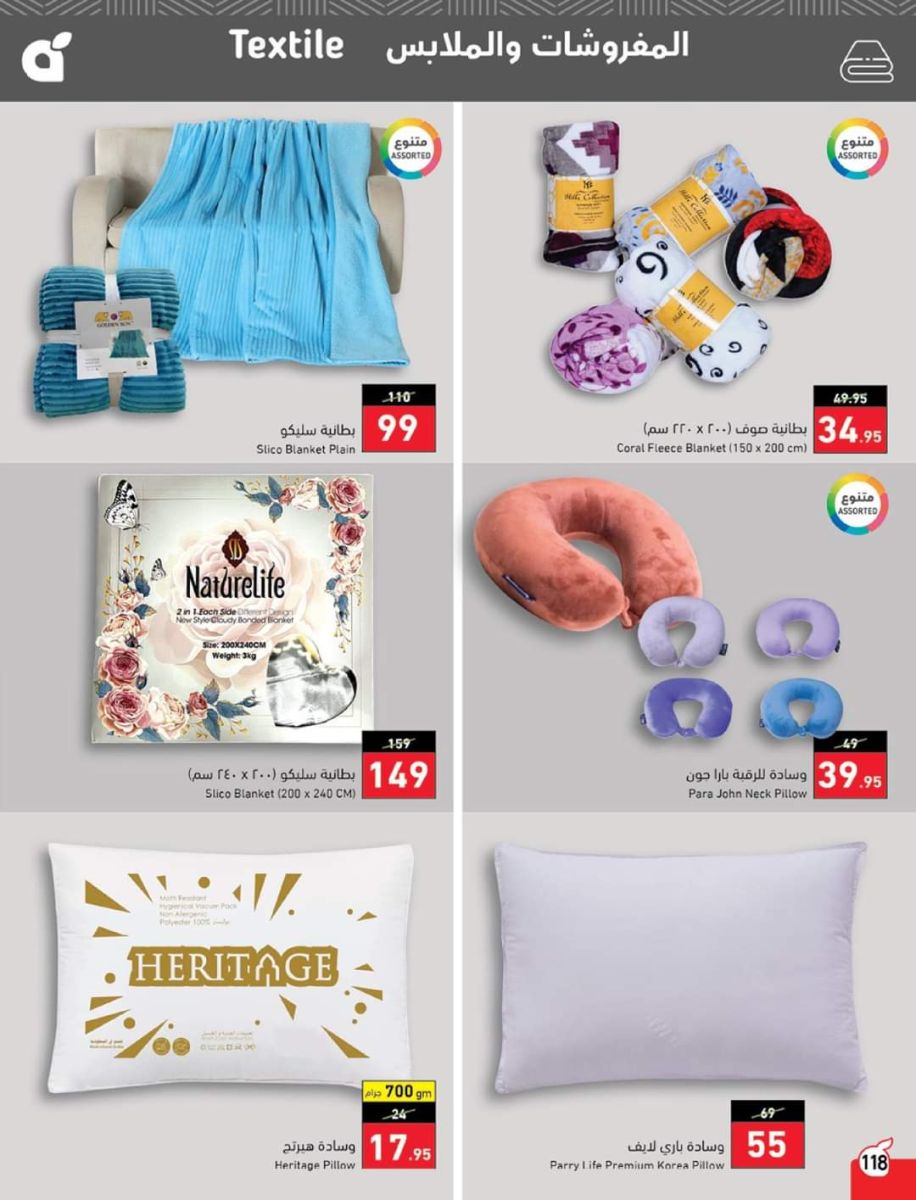

أقوى عروض بنده اليوم على الإلكترونيات والمستلزمات المنزلية والمنسوجات بخصومات هائلة – النبراس الاخبارية

إلحق أوفر عروض بنده السعودية على جميع المنتجات والأجهزة بنسبة خصم خيالية تصل إلى 80% ولفترة محدودة | خدمات السعودية

قطعة تنظيف الغبار من المايكروفايبر | منفضات غبار | مستلزمات تنظيف المنزل | تجهيزات المنزل | المنزل والمطبخ | جميع فئات ساكو | SACO Store

اوتو سمارت منديل مايكروفايبر قابل للطي وخالي من الينت، مكون من 10 قطع بألوان متعددة، بأبعاد 40 × 40 سم | AUTOSMART | العلامات التجارية | SACO Store

طقم مناشف فاخرة 6 قطع مصنوعة 100% من القطن التركي الاصلي عالي الجودة للحمام والمطبخ مكونة من 2 مناشف استحمام، 2 مناشف لليدين، 2 مناشف للتنظيف من اميريكان سوفت لينن - (بقيمة

تسوق تخفيضات الذكري السنوية في عروض هايبر بنده الأسبوعية الأربعاء 22-11-2023 أقل الأسعار - Page 12 of 12 - عروض اليوم - عروض السعودية

أقوى عروض بنده اليوم على الإلكترونيات والمستلزمات المنزلية والمنسوجات بخصومات هائلة – النبراس الاخبارية