dark and lovely| الطريقة الصحيحة لوضع ترطيبة الشعر بدون أي مضاعفات○نتائج أحسن من الكيراتين - YouTube

تسوق غارنييه كولور ناتشورالز كريم صبغة للشعر بلون 4.15 فروستي دارك ماهوغاني بسعة 112 ملل أون لاين - كارفور الإمارات

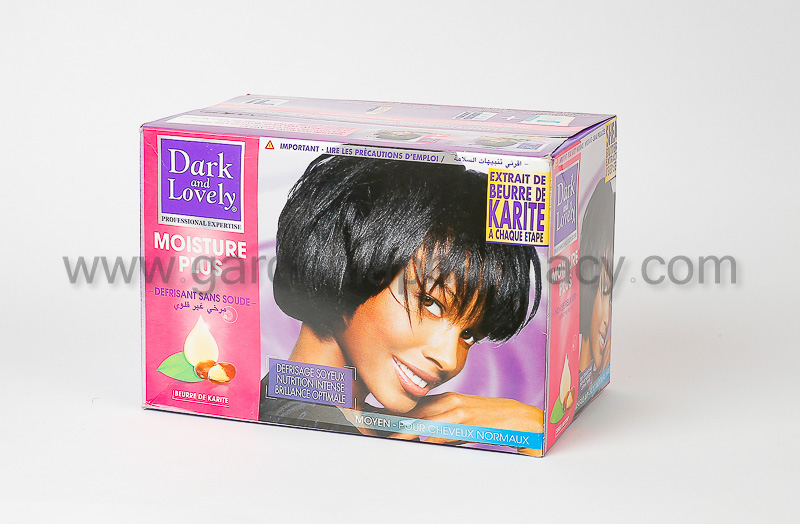

اشتري اونلاين بأفضل الاسعار بالسعودية - سوق الان امازون السعودية: مستحضر فرد الشعر هيلثي غلوس 5 بزبدة الشيا المرطبة بدون غسل من دارك اند لوفلي (سوبر) : الجمال والعناية الشخصية

صاروخ ارض جو لفرد الشعر" .. كريم اشتريه من الصيدليه لن تستغني عنه ابدا لتنعيم الشعر والتخلص من الجفاف والهيشان للابد..!! - بوابة نيوز مصر

Perla beauty - #Precise DIAMOND Dark ans LOVely👍👇 كريم كريم الاسترخاء اللامع ومستقيم من دارك اند لفلي، 🌹🌹 كريم لفرد الشعر موصى به للشعر الخشن أو الكثيف للغاية ،🌹 يوفر كريم فرد

ركن العطور - فرد الشعر Dark and Lovely Super Ultra Relaxer System - كريم ريلاكسر يحافظ على الشعر اثناء التمليس - يوجد في العبوه sample شامبو الذي يحافظ على لون الشعر ورونقه -

تسوق غارنييه كولور ناتشورالز كريم صبغة للشعر بلون 4.15 فروستي دارك ماهوغاني بسعة 112 ملل أون لاين - كارفور الإمارات