جبنة مصرية طرية قليلة الملح 1 كيلو | White Cheese | الأطعمة المبردة | منتجات الألبان والبيض | الطعام الطازج | جميع الفئات | Alain Site

سعر نادك جبن فيتا بيضاء قليلة الملح - 200 غرام فى السعودية | أسواق التميمي السعودية | سوبر ماركت كان بكام

مجمع الخلود الطبي Alkholood Polyclinic - كيف أختار جبن صحي لعائلتي؟ الجُبنَةُ الغذاء المعروف الذي تكاد لا تخلو منه مائدة في العالم. يصنع الجبن من حليب الماعز، حليب الغنم، حليب البقر أو

قم بشراء دومتي تلاجة جبنة بيضاء قليلة الملح 400 جم Online at Best Price من الموقع - من لولو هايبر ماركت Soft Cheese

السعرات الحرارية في الجبنة لايت | سعرات الجبنة البيضاء قليلة الدسم | low fat white cheese calories - YouTube

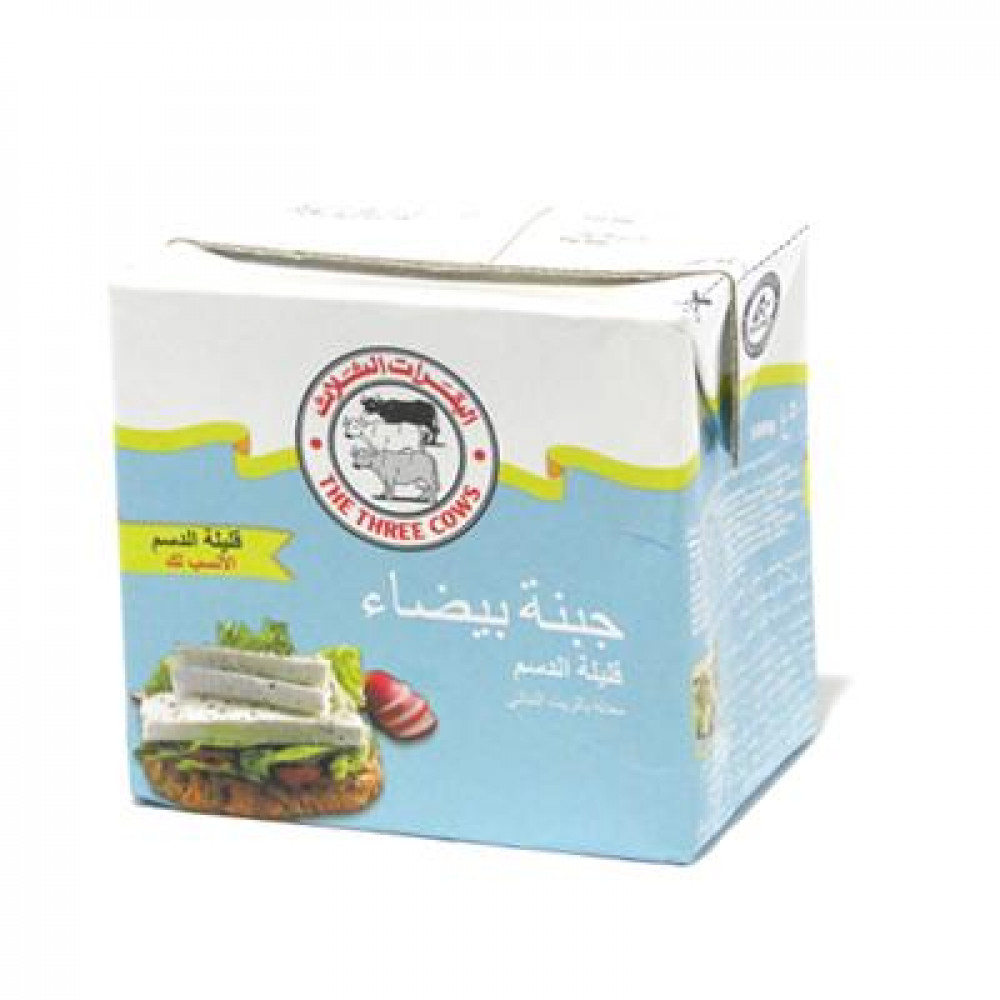

جبنة بيضاء قليلة الدسم | البقرات الثلاث (ماركة) | جملة -- White Cheese Light | The Three Cows (Brand) | Jumla