Huggies Extra Care, Size 6, 15+ kg, Value Pack, 28 Diapers : Buy Online at Best Price in KSA - Souq is now Amazon.sa: Baby Products

تسوق هاغييز إكسترا كير سروال الحفاضات مقاس 6 من 15-25 كلغ حزمة ميغا _أبيض_ 30 حفاض أون لاين - كارفور الإمارات

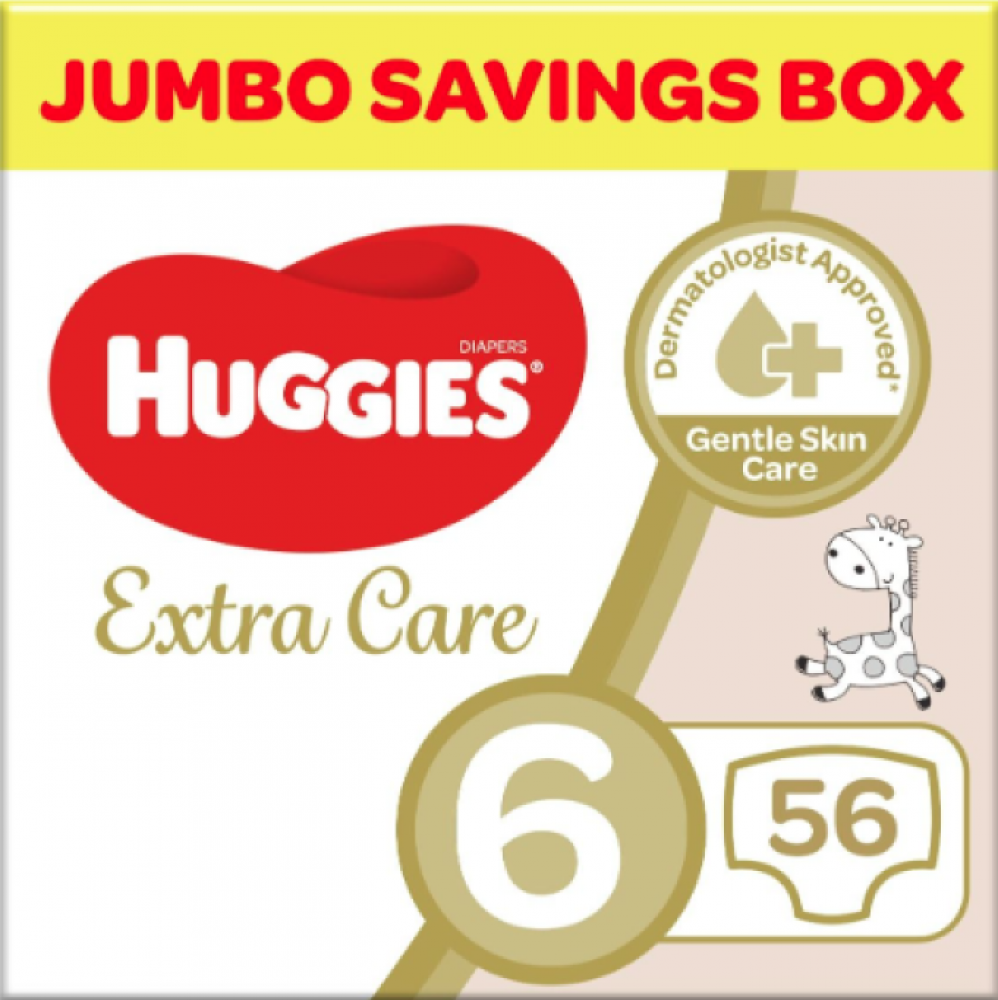

هجيز جامبو مقاس 6, 15-30 كغ, 40 حفاضة - Huggies Jumbo Size (6) 15-30 kg, 40 Diapers – تسوق اونلاين في الأردن | أجهزة طبيه, معدات علاج طبيعي ورياضي, مستحضرات طبيعية,بدائل غذائية